ISV Third Party Solutions to Enhance Dynamics 365 Business Central

Microsoft solutions are comprehensive and continually evolving to meet changing requirements for the market. However, customers with unique industry requirements may need more functionality.

The Liberty Grove Software team has decades of experience with best-of-class proven Dynamics ISV solutions and can recommend, implement, and support these third-party solutions to seamlessly fit your operations.

For new Business Central implementations, we can recommend and implement the best ISV solutions to meet your requirements perfectly.

For existing NAV customers using add-on solutions in their legacy version of Microsoft Dynamics and want to upgrade to Business Central, we can offer skilled resources who thoroughly know how to bring these applications forward successfully.

For VARS looking for extra resources to implement or support ISV solutions, we can provide additional help.

Here are some of the proven ISV solutions we work with to enhance your Dynamics 365 ERP

YAVEON PROBATCH - Breakthrough the boundaries of your Microsoft Dynamics 365 Business Central solution:

- -For small and medium-sized enterprises

- -Customized solution for the life sciences industry

- -Modular design for easy extension

- -More reliable and efficient processes

- -Extends Microsoft ERP with industry-relevant functions

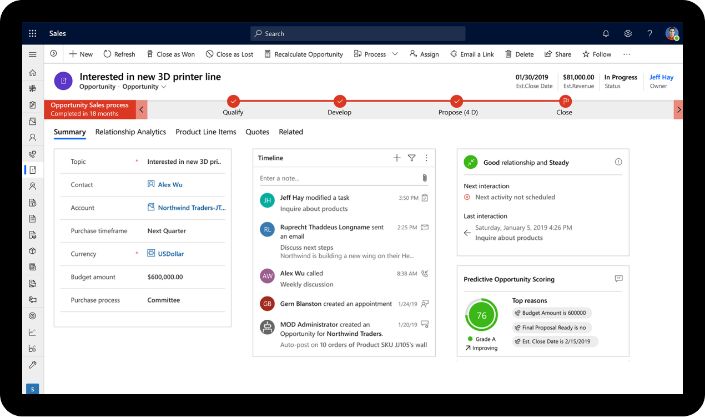

ANVEO - Experts in business process solutions integrated into NAV and Business Central solutions. Anveo has created enhancements to Dynamics for mobile apps, web portals, Power Apps, and EDI.

CLICKLEARN - Technology that captures complicated work processes in Dynamics 365 ERP. Produce learning materials in any language with just a click and publish to a 24/7 learning portal.

CONTINIA - Innovative solutions for AP and AR including expense management, AP matching, approval workflows and document management.

DYNAMICS TMS - A modern advanced transportation management solution fully integrated with Microsoft Dynamics NAV and Business Central.

ENGINEERING CHANGE MANAGEMENT - Engineering Change Management is a simple three step process that gives Microsoft Dynamics 365 Business Central the ability to:

- Notify the department(s) that a change is needed.

- 2. Send a request for the change.

- Execute the change in the production BOM.

FOR NAV - Reports made easy. The ForNAV Designer is an easy-to-use tool for creating and modifying reports for Microsoft Dynamics NAV and Microsoft Dynamics 365 Business Central.

If upgrading NAV, ForNav makes it easy to run legacy reports in Business Central.

INSIGHT WORKS - Business Central manufacturing and distribution apps that include warehouse, inventory, shop floor, scheduling, and CPQ.

INSIGHT SOFTWARE (formerly Jet Global) - Reporting and BI that provides unmatched data access, instant analytics, and controlled budgeting. Gain insights to make better decisions.

LANHAM ASSOCIATES - Proven advanced supply chain technology that provides end-to-end management, from shipping and receiving, to EDI. Available in the cloud or on premise and fully integrated with NAV and Business Central.

NAV EASY SECURITY - Save time, money, and headaches by efficiently managing what users can and cannot do in Dynamics NAV with Login and Permissions and Quick Security.

ONE SOURCE TAX - End-to-end corporate tax automation, with complete flexibility and control. Your team can rapidly standardize and automate multiple corporate tax processes, with flexibility and a full audit trail.

QUALITY MANAGEMENT -

gives manufacturers, distributors, and other companies a consistent, efficient way to assess and record quality metrics in their operations and drive process and quality improvements. Typical, applications for Quality Management include goods receiving, production, purchasing, assembly, maintenance inspection, and issue registration.

REPLICATION MANAGEMENT - simplifies data management as you collect, sync, share, and publish business information to subscribers within and outside of the company.

You perform data management tasks such as defining and publishing information right in Dynamics Business Central.

SPS COMMERCE (formerly DATA MASONS) - Work efficiently with your trading partners with full-service EDI and fulfillment automation services for Dynamics 365.

USTPay - makes collecting payments easy and secure for businesses of all sizes with our industry-leading technology that provides fast, reliable services at competitive prices.