Get Everything Your Growing Business Needs With One Single Connected Solution

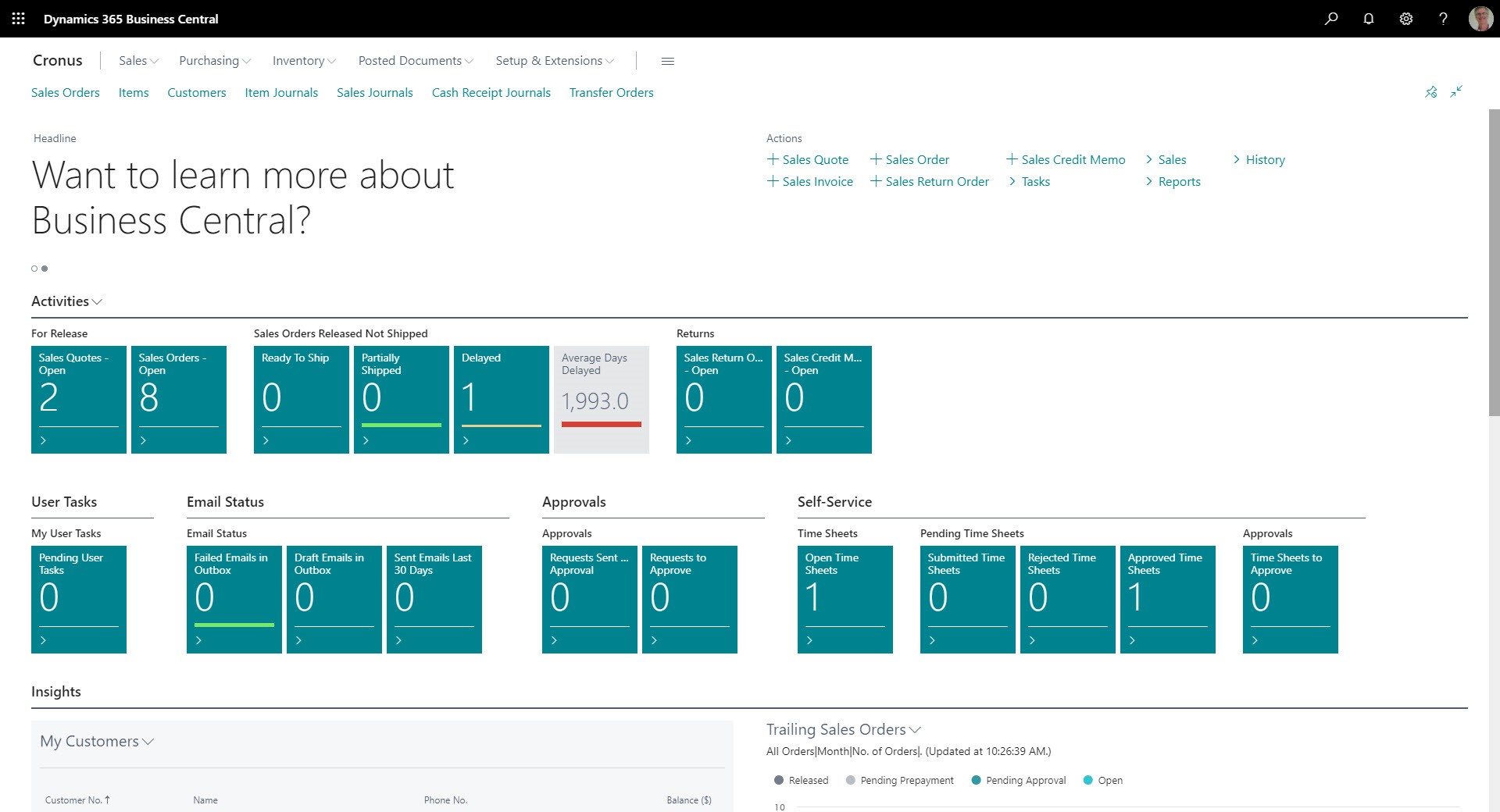

Microsoft Dynamics 365 Business Central is a breakthrough Cloud ERP solution that connects finance, sales, service, and operations, enabling growing companies to deliver what their customers expect. Liberty Grove’s professional team can boost you to productivity with best practices, making the most of your ERP system.

Top Benefits of Dynamics 365 Business Central

Get the Most From Your ERP investment

When you partner with Liberty Grove, you don’t just get the software installed. Instead, you benefit from our 25+ years of knowledge and experience working with Microsoft technologies to transform mid-sized companies to efficiency in various industries.

We know technology, we know best practices, and we understand business.

We’ll make sure your vision and priorities are realized. We add human intelligence and technical know-how to optimize your business and move you forward.

Leverage our expert ERP services to ensure you get the most from your business management system.

Implementations

Upgrades

Training

Dynamics 365 Apps